[ad_1]

Access to capital has traditionally been a barrier to retailers, growers, distributors, and everyone else in the cannabis space. But as Bob Dylan so succinctly phrased it:

The times they are a-changin’

While legalization referendums languished in the halls of Congress, slow progress was being made in individual states.

Come senators, congressmen

Please heed the call

Don’t stand in the doorway

Don’t block up the hall

But, as is the status quo for Congress, the halls have been blocked for cannabis reform for decades.

Who is slow now will later be fast

That aphorism has now manifested in the cannabis industry.

The cadence of progress in the industry has now reached a crescendo, and businesses are regularly growing at a rate that exceeds their means.

Since federal legalization seems to be in an indefinite holding pattern, organizations have emerged to meet the growing need for cannabis businesses to finance and scale their operations.

FundCanna

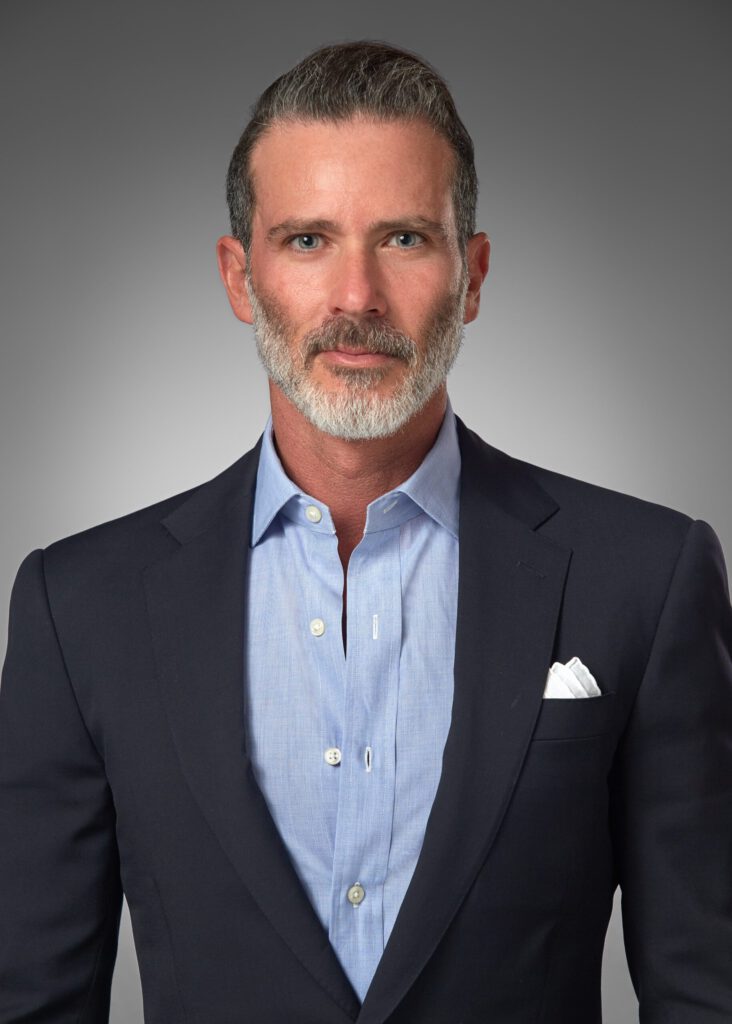

“We are seeing a tremendous appetite for access to capital from the cannabis space,” FundCanna Founder and CEO Adam Stettner said.

Stettner founded FundCanna in Sept. 2021 after spending 15 years lending to non-cannabis small businesses, where his previous company underwrote over a million files.

“In looking at that and realizing the parallel to cannabis, I thought the timing was ideal and the need was fairly strong,” Stettner said.

Because the cannabis industry has matured, businesses in the space resemble traditional small business more than ever. “The parallels between traditional small business and the cannabis business are much greater than I think most people would expect,” Stettner said.

“So we talk to businesses that are doing in the low tens of thousands monthly, and we speak to businesses that are doing well in excess of a million monthly. That was true in traditional or non-cannabis SMB, small and medium-sized businesses. And it is true in cannabis as well.”

Who Qualifies for a FundCanna Loan?

FundCanna provides financing to all 39 states that have passed legislation making cannabis legal. To qualify for a loan, clients must be legal and licensed so that they’re compliant.

“That is an absolute for us,” Stettner said. “And then we will not fund pre-revenue or startup companies. So they must be operating for at least three months and have revenue.

“And then beyond that, we just call on our experience to determine how much a company can comfortably accommodate. But the absolutes are compliance and licensing and operations with existing revenue.”

Rates are adjustable based on need and duration, whether it’s providing capital directly to a client or paying vendors on their behalf.

“How do we make sure it’s a win-win?” Stettner asked. “That goes to the point of, if it doesn’t work for the client, it’s not going to work for us. So the main test for me is repeat business.”

Innovation is in the Product

With financing options becoming more available, companies like FundCanna have to innovate to continue being leaders in the space.

“The main way is to listen,” Stettner said.

“You begin with listening to your prospective client base, in this case, the cannabis supply chain. What do they need? And then, oftentimes the solution to their pain doesn’t exist. And so that innovation is creating financial products that work for them.

“So the main innovation is product,” Stettner said.

“And then second to that is we utilize technology and our experience in underwriting a million-plus files to deliver the innovative product in a way that is simplistic for the end-user.”

Full Throttle

While a lift of the federal cannabis ban has failed to pass the gauntlet of Congress in the past, prohibition is closer to ending now than ever before. On April 1, 2022, the House passed the Marijuana Opportunity and Expungement Act (MORE) for the second time.

Federal legalization would undoubtedly provide the cannabis industry with more options for lines of credit, potentially rendering financing companies like FundCanna irrelevant. However, Stettner believes legalization will benefit the company.

“Although federally illegal, FundCanna is servicing the industry at full throttle right now,” Stettner said. “The benefit of legalization from FundCanna’s perspective is that it opens up banking and access to rails that are not currently available.

“When cannabis becomes federally legal, I expect that it makes things easier for all parties involved. And in that regard, I think automation and many of the tools that make that access to capital faster and simpler will come to fruition.”

Stettner has seen cannabis businesses scale quickly after receiving financing from FundCanna. Cannabis is the fastest-growing cash crop in the country, and demand is driving the need for additional capital.

“I can tell you I think there is a long period between where we are now and seeing any kind of cap,” Stettner said. “ I think that the opportunities are tremendous for the cannabis industry.”

The opportunity to leverage debt from FundCanna as a tool to grow the business is creating exponential growth for clients. It is unlikely the industry will see its ceiling any time soon, given the early stage of legalization and state reform and the current access to capital.

And due to the stage of the industry, opportunities for the cannabis supply chain and the vendors servicing them to use debt to accelerate their growth will also continue to increase.

[ad_2]

Source link